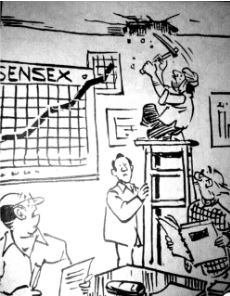

Investing is simple, but the finance industry works hard to make it complex for retail investors.

There are two types of investors:

The pundits: they think they know everything. The pundits make the simple sound complex.

The professionals know that learning is infinite. They invest in what they understand and remain in their circle of competence.

Investing is a journey; the earlier we can start and remain disciplined for the longest time, the better it gets because of the power of compounding (not the way compounding was/is taught in schools). The goal of investing translates into excellent homes for families, better education for children, enjoyable retirements, passing on generational wealth for our loved ones, contributing to special causes we care about and many more.

Today’s popular investment misconception— short-term focus and fast-paced trading for quicker return—so iff you want to learn these misconceptions, this website is not for you. I do not have a magic pill to get rich in a day; my only focus is to help generate long-term returns on every dollar invested.

Financial markets are essentially systems in which the advantage of one investor comes at the disadvantage of the other investor. In short, the principles that work in most aspects of our lives lead to failure in investing. Choosing a sound financial lifestyle, starting early, knowing what you are investing in, investing diligently with patience, and a few more behavioural aspects are more than enough to do better than most investors while investing.

Knowing nothing about investing will be a benefit during this Journey. You won’t have to unlearn many popular beliefs propagated by media and advisors that are not valid. For example, buying expensive financial products does not have to denote high quality or better returns; you are often being ripped off.

Happy Journey!!!

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

– Paul Samuelson